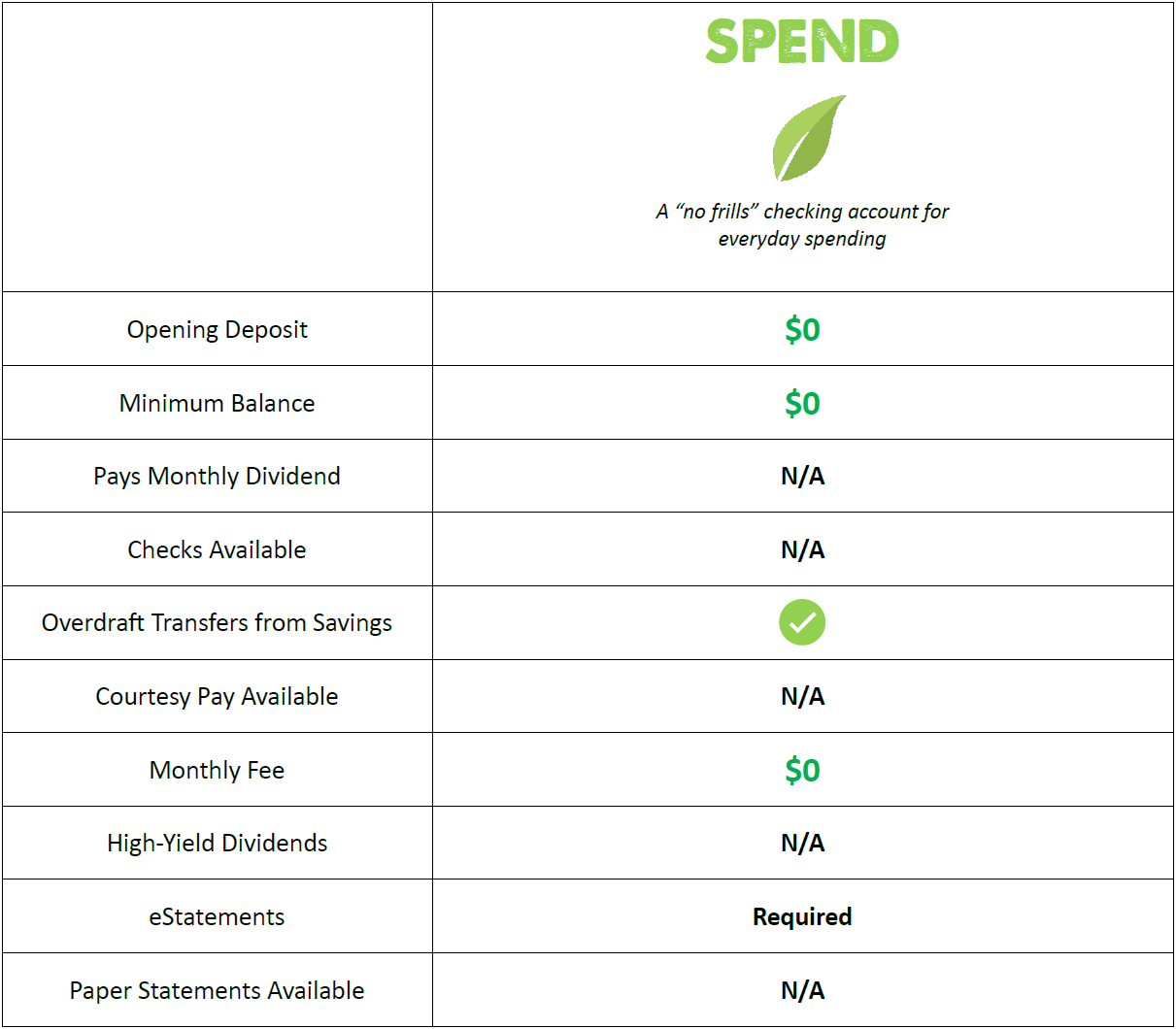

Spend Checking is our “No Frills” Account

Checking is available in three flavors with Veritas FCU. Our “no frills” checking account, called Spend, is dependable and simple. It gets the job done. Transactions are permitted by ACH, ATM, debit card, and electronic transfers. No checks are allowed. If you have money in the account, you can spend it. If not, the transaction will be rejected or returned. See below for an overview of this account.

No dividends are calculated or paid. No minimum balance requirements; however, you must maintain a primary Share Savings account with a minimum balance of $25. Checks are not permitted. Funds must be available to authorize debit transactions. If not, the transaction is rejected or returned. No monthly service charge and courtesy pay is not available. eStatements are required.

FAQs

GREAT RATES & DIVIDENDS

CONVENIENCE & ACCESS

FREE PRODUCTS & SERVICES

FREE EBANKING, EPAY, AND APP